san antonio tax rate property

Property Tax Rate Calculation Worksheets. Public Sale of Property PDF.

Property Tax For 65 Over Homeowners Who Volunteer May Be Lowered

Now 222 Was 265 on Tripadvisor.

. Daniel was able to argue to have the tax rate lowered for our San Antonio home for tax year 2019. Property Tax Inquiries Call 7132909700. Golf Road Suite 389 Schaumburg IL 60173 877-482-9288.

San Antonio TX 78205. There was a 23 percent jump in taxable property values this year. The Foundation Program contributed 222 per pupil for a state-local total.

Pecos La Trinidad San Antonio TX 78207. Search by city state or ZIP code. 109 Dealers near San Antonio TX.

Annual Interest Rate Term of Loan Years. Open footer navigation menu. OConnor can assist you with your property tax protest and help you effectively fight the tax assessment.

Vista Verde Plaza Building 233 N. Truth in Taxation Summary PDF. San Antonio TX 78240 210-226-0829.

PersonDepartment PO Box 839966 San Antonio TX 78283-3966. Taxpayers can also drop off motor vehicle or property tax paperwork needing to be processed in our 24 hour drop-boxes at all four of our locations. Get your rate contact the nearest dealers with Auto Navigator by Capital One.

Hours Monday - Friday 745 am - 430 pm. Table of property tax rate information in Bexar County. City of San Antonio Print Mail Center Attn.

100 Dolorosa San Antonio TX 78205 Phone. Skip to Main Content. Find San Antonio real estate for sale Realtors know the best place to live in San Antonio.

Please consult a financial professional. Hilton Palacio del Rio San Antonio. N30 At an equalized tax rate of 105 per 100 of assessed property -- the highest in the metropolitan area -- the district contributed 26 to the education of each child for the 1967-1968 school year above its Local Fund Assignment for the Minimum Foundation Program.

City of San Antonio Attn. Chicago Office By appointment only 1750 E. See 3845 traveler reviews 1203 candid photos and great deals for Hilton Palacio del Rio ranked 45 of 396 hotels in San Antonio and rated 45 of 5 at Tripadvisor.

Taxing Entity Officials List. Mailing Address The Citys PO. Box 839950 San Antonio.

6400 El Verde Road Leon Valley TX 78238 210 684-1391. The countys market value for our home was over-inflated and he was able to have the tax. Click to have one of our licensed property tax consultants to visit and analyze your texas propertys appraised value and protest your property taxes.

Buy sell or build a house with pool Downtown condos. The average market value for Bexar County homes is 309000. PersonDepartment 100 W.

Box is strongly encouraged for all incoming mail. See participating car dealers near San Antonio TX USA.

Why Are Texas Property Taxes So High Home Tax Solutions

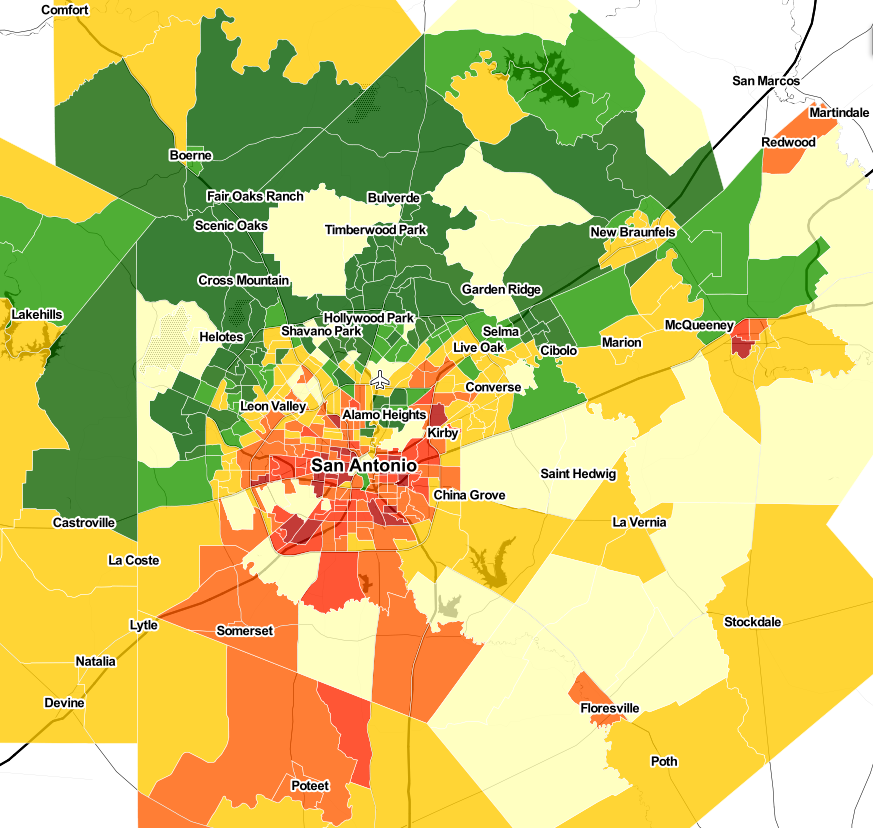

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonio Property Tax Rates H David Ballinger

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill

Sky High Property Appraisals Could Prompt A Higher Homestead Exemption For Sa Homeowners

Tax Rates Bexar County Tx Official Website

Tac School Property Taxes By County

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Tac School Property Taxes By County

Tac School Property Taxes By County

San Antonio Real Estate Market Stats Trends For 2022

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Which Texas Mega City Has Adopted The Highest Property Tax Rate

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled